Buy Side Sentiment Tracker - October 2025

Bullish Tech & EM

Sentiment Matters is the new home of my work on Investor Sentiment & Positioning, the mood of the market, mapped and decoded.

Sign up for free or for one of the subscription packages at

www.sentiment-matters.com

Here is a taste of what you can expect, the brand new edition of our Buy Side Sentiment Tracker. What are asset managers buying…or fading?

The latest views from 42 top asset managers, offering insights into consensus positioning across 70 assets, with over 1200 individual views.

Main takeaway

Buy-side sentiment most bullish in 8 months, but not pushing to new highs

Tech sentiment is getting very bullish on the buy side, on all measures

Everyone loves EM, both in equities and bonds

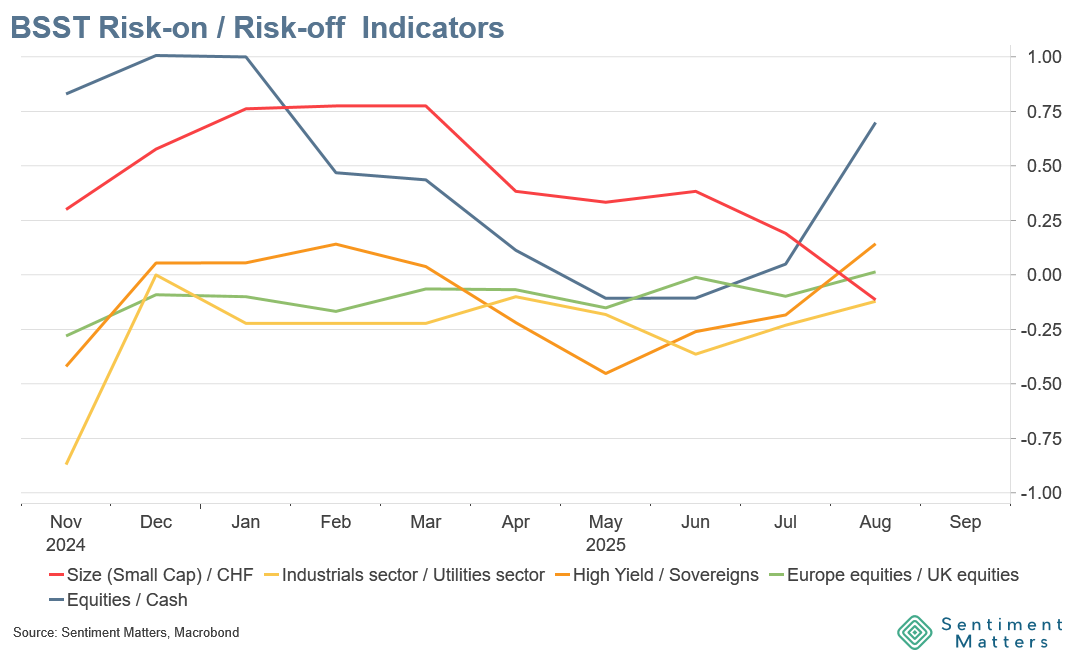

Sentiment: More and More Bullish

A broad shift toward bullishness across nearly all indicators.

Risk appetite improved in 4 of 5 risk-on/risk-off gauges.

The aggregate risk-on indicator is at its highest since February.

Equities vs Cash: approaching January highs.

Cash: least popular since November 2024.

Equities: 67% net bullish — highest since March.

Sovereigns: sentiment drifting lower, weakest in 12 months.

Biggest monthly move: equities up, cash down.

All defensive sectors downgraded this month.

Small Caps: downgraded again.

Equity Regions: EM Leads, US Recovering

Emerging Markets & China: remain clear leaders — the most popular region for the fifth straight month.

Chinese equities now 62% net bullish after further upgrades.

Developed Markets: no strong regional preference overall.

US: significant recovery. After six months as least popular, now in third place, up from 15% net bearish in May to 25% net bullish in October.

Europe: sentiment fading — now the least popular DM region after downgrades. Spring optimism peaked in August.

Japan: neutral. Investors on the fence, but with room for upgrades if a new growth or reform narrative emerges post-political change.

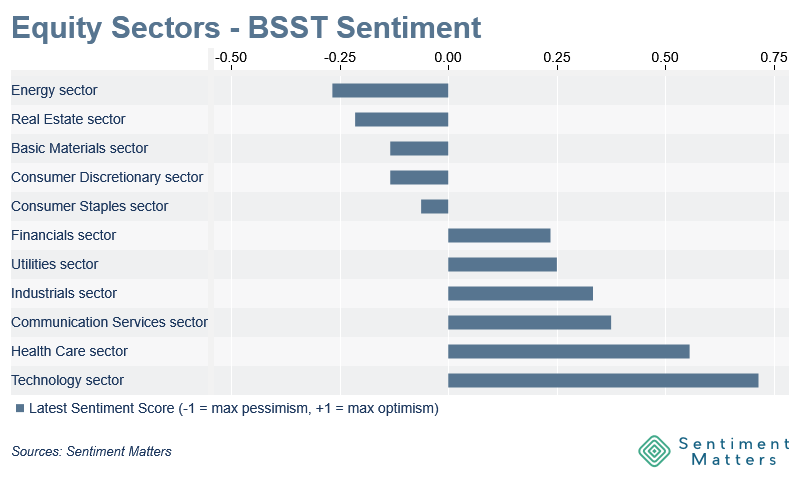

Equity Sectors: Bullish Tech, Defensive Downgrades

Technology: buy side is very bullish on Tech. By far the most bullish sentiment

Largest upgrades this month in Information Technology and Consumer Discretionary.

Tech: 22 Bulls, 2 Bears, a handful of Neutrals.

Defensive sectors: all downgraded, though a small defensive tilt (vs cyclicals) remains.

Health Care: some downgrades; no longer top sector, but still broadly bullish — sentiment likely to be helped by Pfizer’s rebound.

Consumer Staples: least popular defensive sector — slightly more Bears than Bulls, lowest allocation in a year.

Utilities: downgraded for a fourth consecutive month; lowest allocation in 12 months.

Energy: sharpest downgrades for the second month in a row — now the most negative sector, though not at January lows.

Consumer Discretionary: significant upgrades — no longer most unpopular; mid-pack, likely aided by Tech exposure.

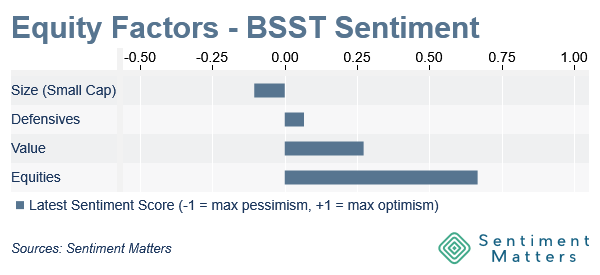

Equity Factors: Small Caps fading

Small Caps (Size): steady downgrades since January; now more Bears than Bulls. Reflects fading growth optimism.

Value: modest upgrades, but still only slightly net bullish despite recent performance.

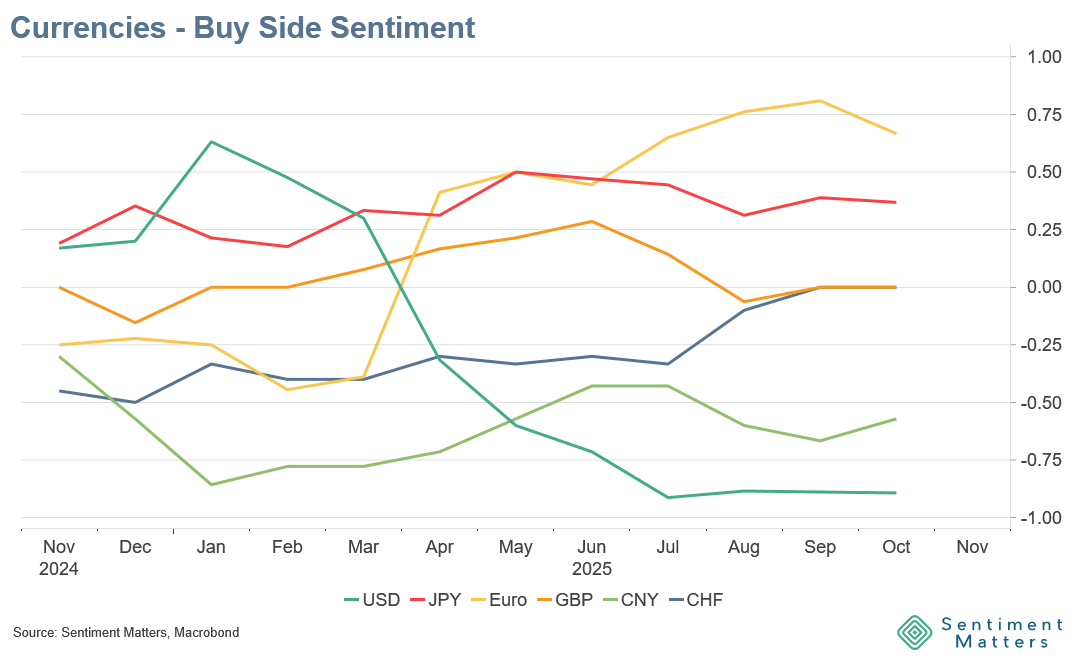

Currencies: Euro Bullishness, Dollar Extremely Unloved

Euro: remains most popular currency for the fourth straight month, despite mild downgrades. CFTC positioning confirms this bullishness.

US Dollar: remains extremely bearish — the least popular asset overall at -89% net bearish.

0 Bulls, 3 Neutrals, 25 Bears.

Biggest sentiment swing YTD: from consensus long to consensus short.

CFTC data shows no improvement.

CHF: recovered from being most unpopular last year to fully neutral (equal Bulls and Bears).

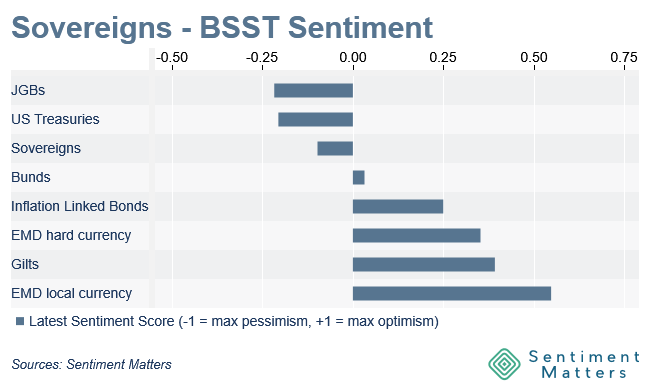

Sovereigns: Everyone loves EMD

Overall downgrades as risk appetite increased.

Sentiment across sovereigns has converged:

JGBs: most upgrades this month; now level with Treasuries after being deeply bearish earlier in the year.

US Treasuries: upgraded, but still net bearish.

Bunds: now neutral (equal Bulls and Bears), down sharply from +31% net bullish in July.

Gilts: still the favourite at +40% net bullish, though slightly downgraded this month.

EM Debt: very bullish — both local and hard-currency bonds saw gains. Local bonds are the most popular fixed-income asset, helped by USD bearishness.

Inflation-Linked Bonds: upgraded to 25% net bullish, mid-range for 2025.

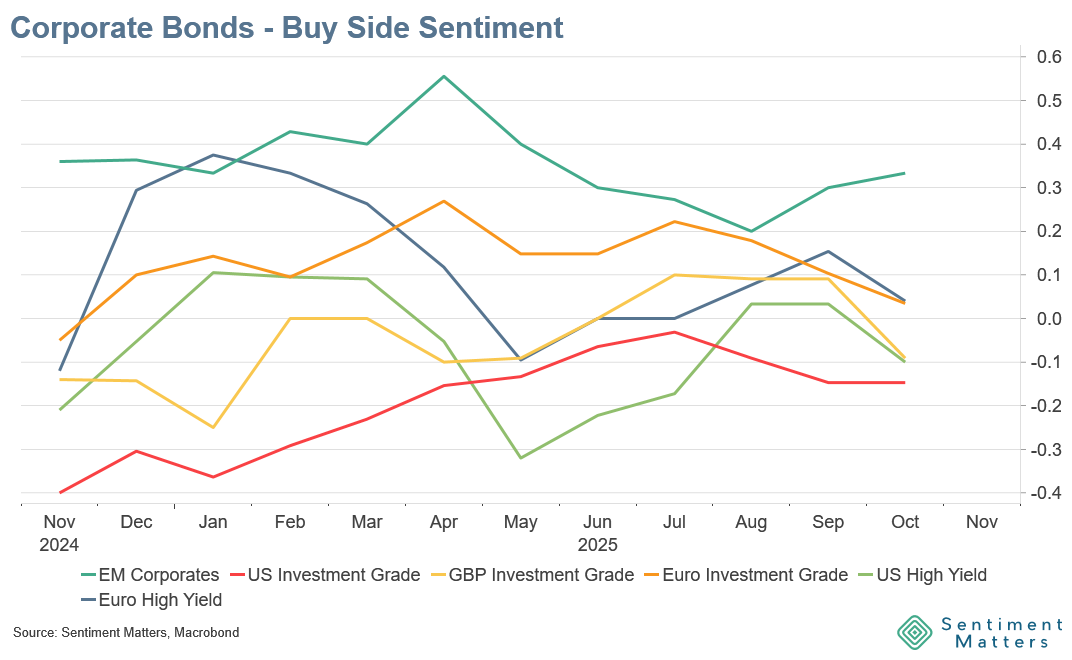

Credits: High Yield Downgraded

High Yield: downgraded in both US and Europe, but still slightly preferred over IG.

Investment Grade: small downgrade, mainly in Europe.

Private Credit: unchanged and still overwhelmingly bullish.

Europe remains preferred over the US for both HY and IG, though the gap is narrowing.

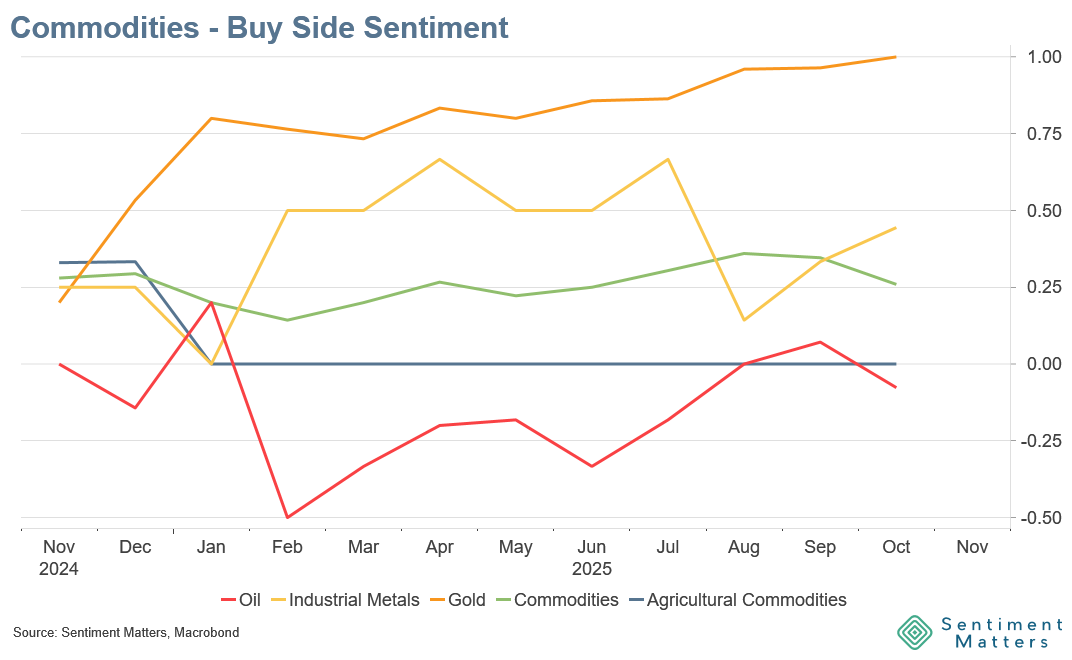

Commodities: Gold Max Bullish

Gold: literally maxed out — 30 Bulls, 0 Neutrals, 0 Bears.

Every expressed view is bullish. If there are Bears, they are keeping quiet about it. Buy-side commentary echoes similar optimism for Silver.

Oil: further downgrades; back to -7% net bearish, in line with Energy sector downgrades. Still mid-range for 2025.

Industrial Metals: modest upgrades, middle of the range.

Alternatives

Alternatives: entrenched consensus — Infrastructure remains universally loved, even more than Private Credit.

When narratives become this one-sided, momentum can carry further short-term, but vulnerability to negative news rises.

Crypto: still minimal institutional participation — only two official views (one Bull, one Bear).

Have a great week — and good luck out there.

—Lars